A Guide to Navigating the CBAM: Step-by-Step

Discover how businesses can effectively navigate the Carbon Border Adjustment Mechanism (CBAM) with this comprehensive guide.

In an era where sustainability and environmental responsibility take center stage, businesses are facing increasing pressure to not only reduce their carbon footprint but also gain a comprehensive understanding of their supplier chain emissions, particularly in Scope 3. With the implementation of Carbon Border Adjustment Mechanism (CBAM) and the stringent requirements imposed by SBTi (Science-Based Targets initiative) and CSRD (Corporate Sustainability Reporting Directive), it has become imperative for organisations to navigate the complex landscape of carbon calculations and emission sharing.

Understanding the CBAM and Its Implications

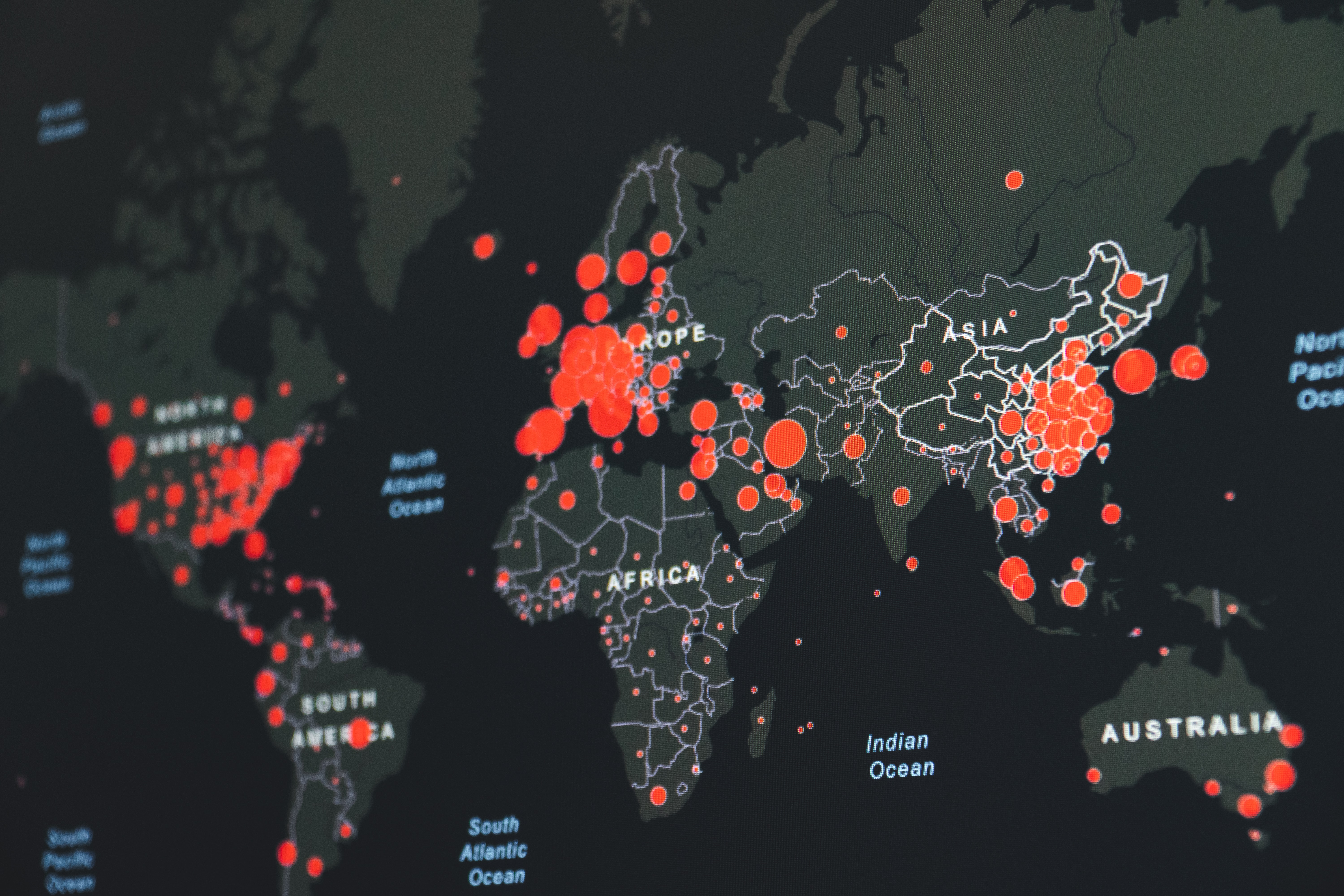

The Carbon Border Adjustment Mechanism (CBAM) is a regulatory framework designed to address carbon leakage and ensure a level playing field for businesses in a global market. Essentially, CBAM aims to create a transparent and fair system by placing a carbon price on imports, reflecting the carbon content of the goods entering the market.

The CBAM has several key implications, including potential pricing increases for imported goods, the need for businesses to assess and reduce their carbon footprint, and the possibility of trade disputes and challenges in implementation. It is crucial for businesses to assess their current practices and make necessary adjustments to align with the CBAM regulations.

Key Features in a CBAM Solution

Collect PCF Data from Suppliers

While ClimateCamp excels at facilitating collaboration and data collection from suppliers, it is critical to ensure that your CBAM solution can efficiently collect Product Carbon Footprint (PCF) data from suppliers, offering a comprehensive perspective of the carbon emissions associated with your imported goods.

Calculate Financial Impact (EU Tax)

Look for a CBAM solution that can accurately calculate the financial impact of the EU tax based on the carbon content of your imports. This feature ensures that your organization is well-prepared to manage the financial implications of CBAM compliance.

Send Declaration to EU Customs

To streamline the CBAM compliance process, it's crucial to have a solution that can seamlessly generate and send declarations to EU Customs. This ensures that your organization remains compliant with regulatory requirements and avoids potential penalties.

A Step-by-Step Guide for Businesses

Let's take a look at the process of the CBAM...

.png?width=1920&height=1080&name=Slide%2016_9%20-%201%20(1).png)

1. List Products Under the CBAM

Importers begin by identifying the products subject to the CBAM regulations. Importers must rigorously categorize these products and determine their country of origin in order to accurately assess carbon content and comply with CBAM regulations.

2. Importer Requests PCF from Producer

Once the products subject to CBAM have been identified, importers reach out to the producers or manufacturers in other countries to request information on the PCF associated with those products. The PCF data provides information on the amount of greenhouse gas emissions produced during the product's lifecycle (raw material extraction, production, transportation, and disposal).

3. Producers provide PCF to Importer

After receiving the request, producers or manufacturers provide the requested PCF data to the importer. This data report includes detailed information on the carbon emissions associated with the production process of the specific product. It may involve providing emissions data for each stage of production, as well as documentation describing the process used to calculate the PCF.

4. Importer compares PCF Producer with PCF from EU

After receiving PCF data from the producers, importers compare it to the PCF benchmarks established by the European Union (EU) for similar products. The EU sets PCF standards based on the average emissions intensity of products manufactured within the EU. Importers use this comparison to assess whether the carbon content of the imported products meets the EU's standards.

Importers conduct a thorough analysis to determine any discrepancies between the PCF provided by the producer and the EU's PCF benchmarks.

If PCF Importer is lower than PCF EU:

If the PCF reported by the producer aligns with or is lower than the EU's PCF benchmarks, the importer can proceed with importing the products without additional carbon adjustments.

If PCF Importer is higher than PCF EU:

If the PCF exceeds the EU's standards, the importer is required to take corrective measures to offset the excess carbon content, such as paying a carbon tax or obtaining carbon allowances.

Stay ahead of regulatory changes by using the insights gained from ClimateCamp. Prepare your organisation for CBAM compliance, ensuring a smooth transition into the EU's new carbon pricing system.